Providing and delivering your financial aid is our top priority here at San Joaquin Delta College. Your choices in how you receive your money matters, so Delta College delivers your refund with BankMobile Disbursements, a technology solution, powered by BMTX, Inc. Visit this link for more information: https://disbursements.bmtx.com/refundchoices/.

Learn More About Your Refund Choices

Additional Resources:

How to Receive Your Refund

San Joaquin Delta College (SJDC) delivers your refund with Bank Mobile Disbursements providing you with choices and offering great customer service.

The most common type of money we disburse to students are funds left over from financial aid awards, loans, or grants after tuition has been paid.

Students receiving these funds have usually requested this additional support to help them with books and living expenses.

If you don't receive financial aid, you still may receive money back from SJDC in the future.

Going through this process now can ensure you'll receive any money owed to you by SJDC in a timely manner.

Here's what you need to do to get started

- First, make sure your mailing address is up to date with your school.

- Look for an email from BankMobile containing your Personal Code to validate your identity. This code is needed to select how you will receive your refund money.

- The kit will include a Personal Code to validate your identity. This code is needed to select how you will receive your refund money.

- You will also receive a Personal Code by email which will be sent to the email address on record with your school.

- Next, go to refundselection.com and enter your Personal Code.

- Select how you would like to receive your money.

- After eight days, if you have not selected, look for a bright green envelope in the mail. This is your Refund Selection Kit. Please follow steps 3-6 once you receive this kit.

The choices you will see are:

Deposit to an existing account: money is transferred to an existing account the same business day we receive the funds from your school. Typically, it takes 1 - 2 business days for the receiving bank to credit the money to your account.

Deposit to a Bank Mobile Vibe checking account: if you open a Bank Mobile Vibe checking account (upon identity verification), money is deposited the same business day we receive the funds from your school.

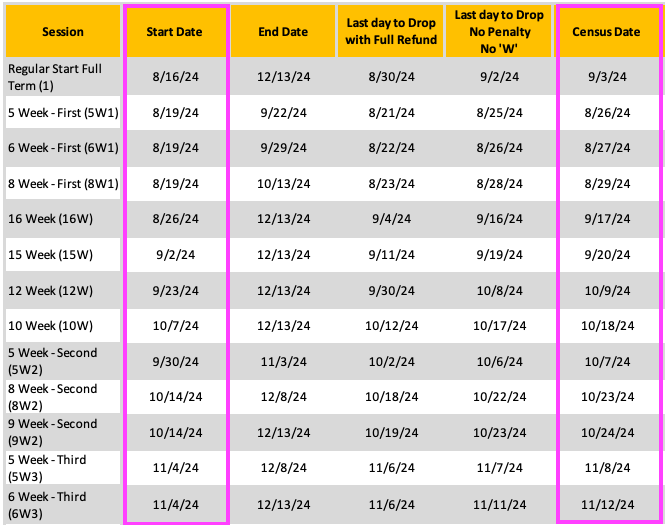

Disbursement Schedules

We make every effort to maintain the published disbursement schedule; however, it is subject to change.

Credit Balance Disbursements

Please be aware that schools have up to 14 days from the time your funding is applied to your student account to release your funds. Although we try to get these credit balances to students within 2-3 days after funds are applied to your account, we may experience some unforeseen circumstances that could hold up this process. Funding will ultimately be released by no later than the 14th day.

Degree Audit

All student courses are evaluated to determine if each course is applicable to the completion of a student’s program. Courses that are not part of a student’s program of choice, or any additional courses needed for transfer, are not courses that are covered with Federal financial aid. Other Financial Assistance may be used to cover these courses.

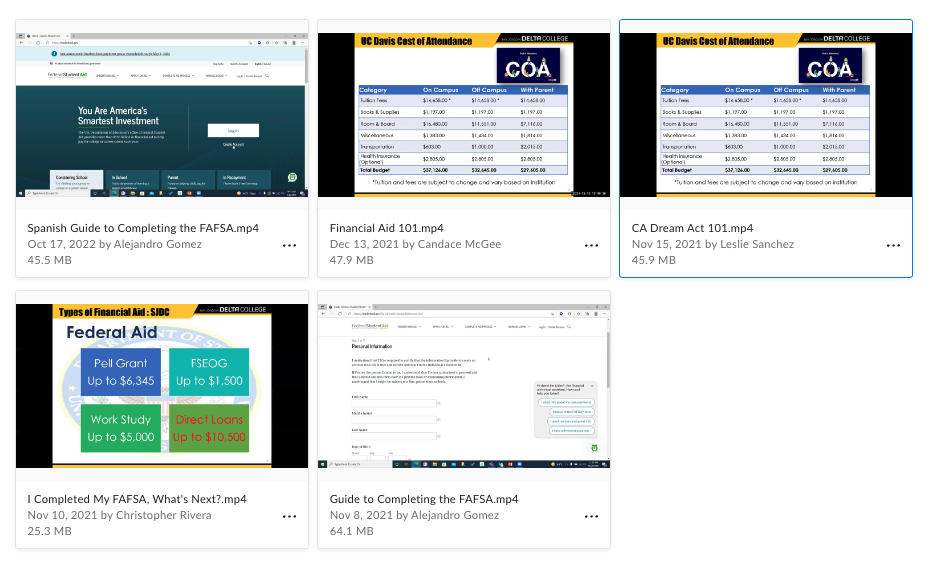

ADDITIONAL FINANCIAL AID VIDEOS

ADDITIONAL FINANCIAL AID VIDEOS FINANCIAL AID WORKSHOPS

FINANCIAL AID WORKSHOPS